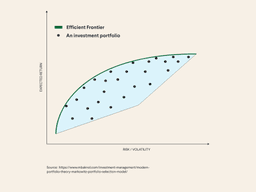

Efficient Frontier

The efficient frontier is a set of investment portfolios generating the maximum expected return given a defined level of risk, or, conversely, offering the lowest level of risk given a defined expected return. The cornerstone of Modern Portfolio Theory (MPT), the efficient frontier was introduced by Nobel Laureate Harry Markowitz in 1952.

As seen on the graph above, the efficient frontier is a curved line given that additional risk does not always result in an equivalent increase in portfolio returns. Portfolios residing below the frontier are sub-optimal, meaning that they do not provide adequate returns considering their level of risk. Security annualized standard deviation is represented by Risk/Volatility on the X-axis, while compound annual growth rate (CAGR) is represented by Expected Return on the Y-axis.

Because risk is determined by standard deviation, lower covariance between securities results in lower risk. This is why optimal portfolios typically exhibit a higher degree of diversification than their suboptimal counterparts. There are several ways for investors to diversify, most notably through alternative asset allocation, which can significantly reduce covariance in a portfolio. Learn more about diversification through commercial real estate here.

Limitations of the Efficient Frontier

The simplicity of the efficient frontier is great in theory, but it does have its limitations. Built on a handful of assumptions, this theory does not always hold up in varying situations.

- Assumption of Rationality: The efficient frontier assumes all investors will act rationally in avoiding undue risk, which is not always the case. There are several factors that may contribute to an investor’s decision aside from what is technically rational.

- Assumption of Normal Distribution: The efficient frontier assumes that investments will generate returns following a normal distribution. In reality, returns may vary significantly from the mean, affecting the calculation of risk, which is calculated based on the standard deviation of returns.

- Assumption of Access: The efficient frontier assumes that investors can create optimal portfolios with their unlimited access to borrowing and lending money at a risk-free interest rate. However, investors do not all have equal access to borrowing and lending money, with some being able to influence market prices and others unable to obtain adequate capital.

The Bottom Line

This model of determining an efficient portfolio is a key element of Modern Portfolio Theory and a strong proponent of diversification. Though not a perfect theory, it can be an effective tool to benchmark performance. It is also worth noting that every efficient portfolio will be different, depending on the investor’s risk tolerance.