Welcome to Modern

Real Estate Investing.TM

Build a more diversified portfolio, starting with just $5k.

1

Sign up in minutes.

2

Invest in vetted real estate.

3

Easily build a more diversified portfolio.

1

Sign up in minutes.

2

Invest in vetted real estate.

3

Easily build a more diversified portfolio.

Featured In

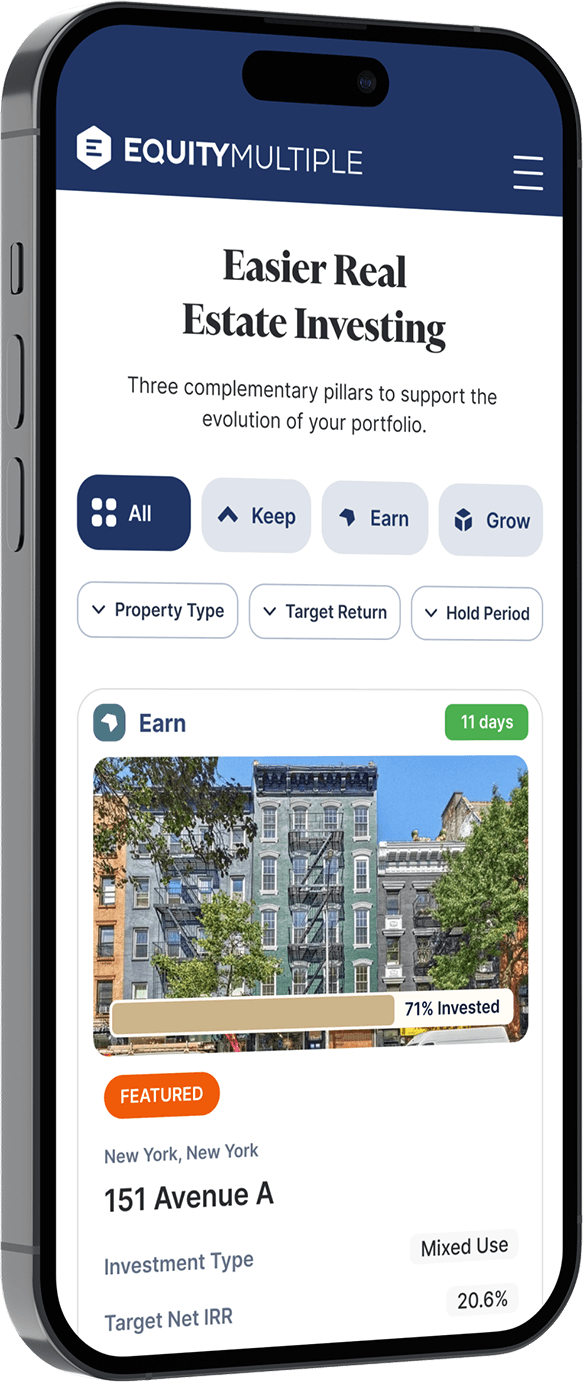

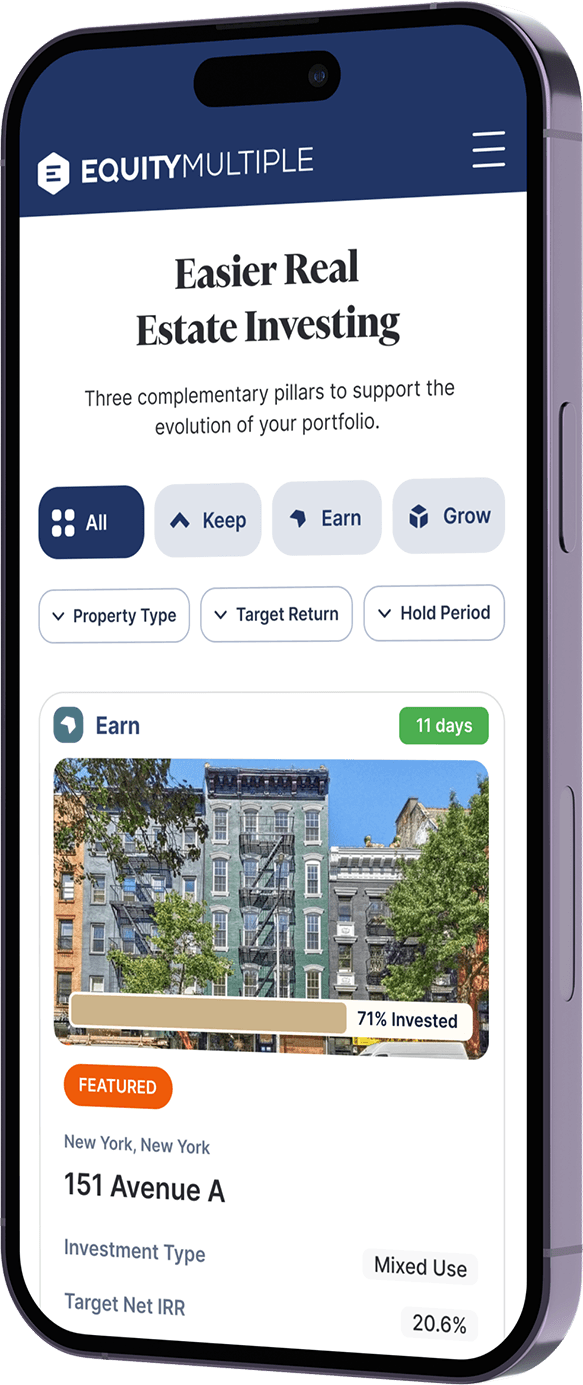

Real estate investing, simplified.

We bring you streamlined access to private-market CRE. Take the smart step beyond stocks and bonds.~5%

Acceptance rate

of investments considered

Achieve New Heights

EquityMultiple conducts extensive due diligence, accepting only around 5% of investments we consider. We structure investments to bring you the highest degree of protections. Each time you invest, our industry-leading asset management team goes to work to maximize your returns and protect your capital.

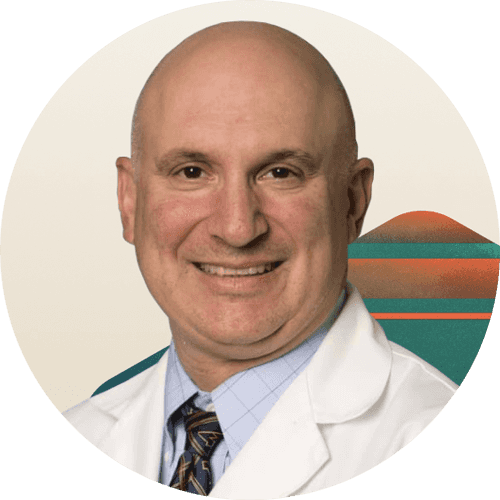

“We help investors scale their real estate portfolios with institutional diligence and asset management throughout the life cycle of each investment.”

Marious SjulsenCo-Founder and Chief Investment Officer

What EquityMultiple Investors Are Saying

This testimonial may not be representative of all EquityMultiple investors. This testimonial was unpaid and of an actual investor of EquityMultiple.

Read All Investor StoriesWhy Private-Market CRE Investing?

Go beyond stocks and bonds.

Why Private-Market CRE Investing?

Go beyond stocks and bonds.- Low correlation to stocks and bonds.

- Attractive historical risk-adjusted returns.

- Less historical volatility than stocks and REITs.

Risk-Adjusted Return31990-2019

Risk-Adjusted Return31990-2019

Connect With Us

Our dedicated Investor Relations Team is standing by to help simplify your real estate investing process.