Short Term Investment

What is a Short-Term Investment, Really?

A short-term investment is an investment that can easily be converted into cash. Short-term investments are fairly liquid, with hold periods no longer than five years. Many investors choose to participate for even shorter amounts of time, from three months to one year.

Short-Term Investment Examples

Savings accounts, certificates of deposit (CDs), money market accounts, and Treasury bills (T-bills) are common types of short-term investments. See below for a brief description of each:

- Savings account: A type of bank account that enables you to store money, while earning some interest. Rates are typically lower than a long-term investment, but higher than a checking account, which is designed primarily for your daily spending needs.

- Certificate of deposit: A CD is a type of savings account in which investors agree to hold their money for a specified time in exchange for a fixed interest rate. While the terms are generally favorable, note there may be a penalty for early withdrawal.

- Money market account: Functionally similar to a savings account, but with some of the perks of a checking account (i.e. debit card and checks).

- Treasury bill: T-bills are essentially loans to the U.S. government. The Treasury Department issues T-bills in 4, 8, 13, 26, and 52-week terms. Investors typically receive T-bills at a discount from the face value; upon maturity, they then receive the par amount.

Short vs. Long-Term Investment Goals

Prior to investing, it’s important to consider your risk tolerance and individual goals. For instance, in times of economic uncertainty, investors may want to move more of their money into short-term investments, which tend to provide greater flexibility and less volatility than long-term assets like stocks. Short-term investments may also be a good fit for investors looking to meet specific short-term goals, such as saving for a down payment.

In general, short-term investments may be potentially safer than long-term investments, which can involve higher risk, along with higher returns. That said, short-term investors often sacrifice higher yield for the ability to access cash quickly. For this reason, you may want to optimize your portfolio with a strategic mix of short and long-term investments.

A New Type of Short-Term Investment

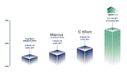

EquityMultiple’s Short Term Notes are an elevated alternative for your savings. A few quick highlights:

- Yield-Focused: Diversified notes offering a fixed rate and intended to provide a flexible cash management tool.

- Short Duration: 3, 6, or 9-month maturities.

- No Fees and First-Loss Protection: Fee-free to investors and backed by First-Loss Protection, a feature where EquityMultiple co-invests in a first-loss position.

For a more detailed overview, please see this article.

*Alpine Notes are not FDIC insured and are not savings accounts

*Past performance does not guarantee future results

*Source of leading CD rates is www.fdic.gov/resources/bankers/national-rates, as of 3/21/2023. APY based on rates offered as of March, 2023. Actual interest rates offered will vary based on duration and time at which they are being offered. Returns are not guaranteed. This product is not offered by a bank and as such it is not FDIC insured. However, to help Alpine Note investors EquityMultiple offers First Loss Protection (see FAQ on First Loss Protection below.)